As negotiations regarding Brexit terms between the United Kingdom and the European Union continue to evolve, the probabilistic implications for investors are also evolving. Foreign developed markets rightfully account for a meaningful portion of most well-diversified investment portfolios, and the terms of the final Brexit deal…

Determining Withdrawal Rates for Retirement Income

Many investors depend on interest and dividend cash flow from a tailored income portfolio as they transition into retirement. A diversified allocation of bonds and high-yield stocks, in addition to a selection of growth-focused equities to keep pace with inflation, can provide the consistent cash flows necessary to transfer from a steady paycheck to a sustainable high quality of life in retirement. A portfolio income strategy, however…

Projecting the Impact of a Vaccine on Various Sectors and Countries

As pharmaceutical companies including AstraZeneca, Pfizer, Moderna, and BioNTech make strides toward developing and producing viable vaccines to provide immunization against the Covid-19 virus, it’s worthwhile from an investment perspective to assess which countries and economic sectors may…

Inflation Adjustments for Tax-Sheltered Retirement Plans

Retirement plan tax shelters provide investors with one of the most advantageous opportunities to build wealth by protecting capital gains, dividends, and interest from taxes and amplifying the powerful force of compound growth. To adjust for inflation, the IRS has updated several…

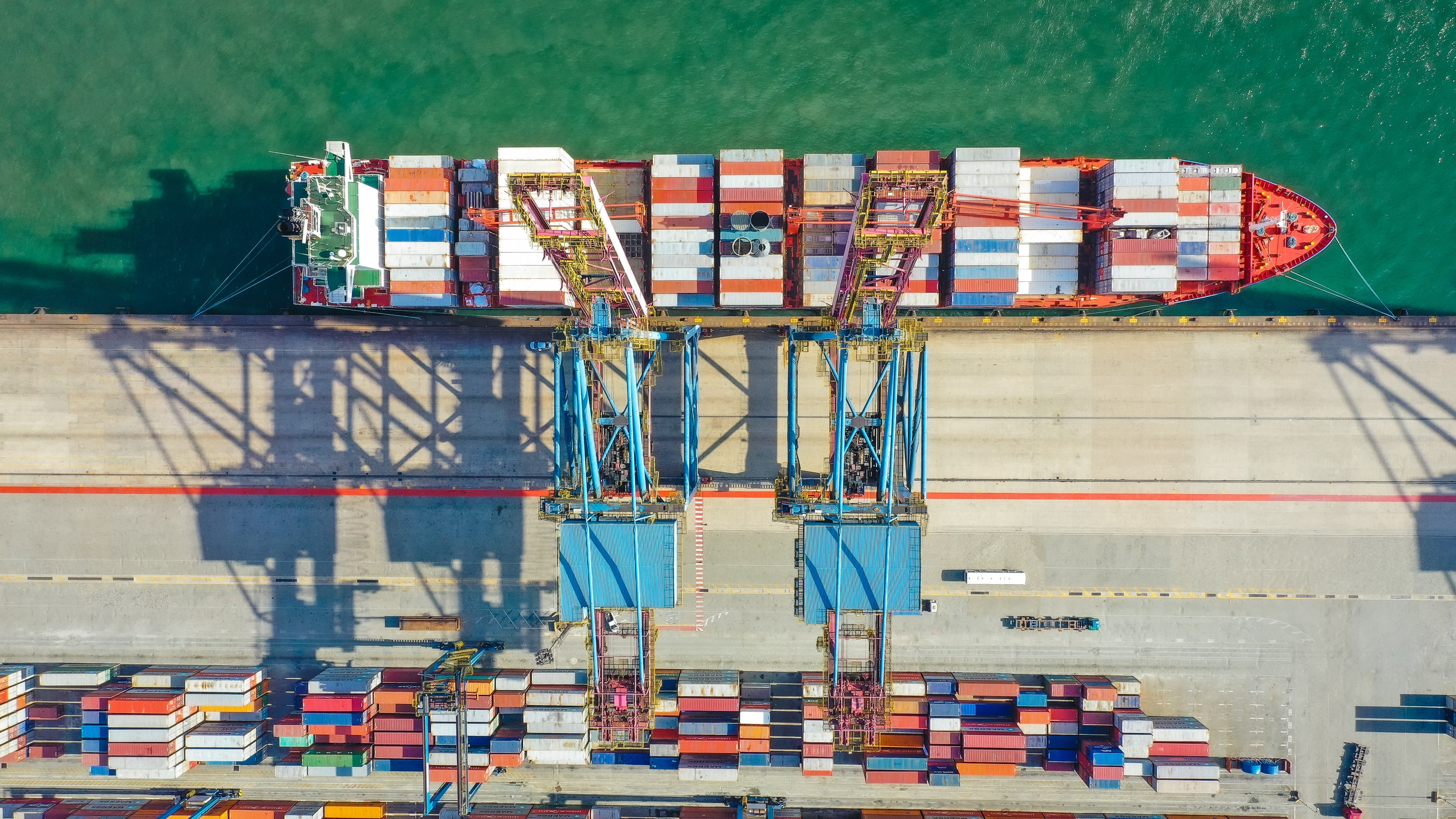

Tariff Considerations in an Administration Change

International stocks comprise a meaningful portion of most appropriately allocated diversified investment portfolios, which serves to mitigate idiosyncratic geographic risk. For countries that engage in extensive trade with the United States, such as China, tariff policies can…

Market Impact from Election Day

As all investors know, election results have an impact on markets, whether by maintaining the status quo, providing a mandate for massive change, or something between the two extremes. The precise impact can often be difficult to determine. For instance…

Low Interest Rates and Investor Risk Tolerance

In the current environment of ultra-low interest rates, which are often negative real rates after accounting for the impact of inflation, income-seeking investors are often faced with a decision regarding whether to accept increased volatility and risk in order to pursue higher yields. These yields can…

Central Bank Digital Currency

The Federal Reserve is exploring the possibility of issuing digital currency backed by the central bank (CBDC) at some point in the future, which may have significant implications for cross-border international monetary transactions and other areas of the economy. As noted in this article…

Third Quarter Earnings and the Economy

Earnings season is kicking off, with several major banks reporting their quarterly results this week. These results can often serve as a barometer for the greater economy at-large, given that many sectors and industries interact with banks as they secure financing, issue debt and equity to investors…

Watching Global Economic Trends

While observing domestic and global economic activity trends, an investor would be well-served to keep in mind their specific investment time horizon. Particularly in the case of assessing an economic recovery, precise timing is important for investors with a short time horizon because discrepancies between short-term economic indicator expectations and results can cause significant volatility in equity and debt markets. Investors with a longer time horizon, however, can take advantage of the fact that…

Assessing the Quality of Bank Dividends

Dividends can provide essential tax-advantaged cash flows to investors’ portfolios for the purpose of opportunistic tactical reinvestment and periodic income distributions. Banks are currently priced at relatively low levels and, as a result, boast relatively high dividend yields. The low stock prices aren’t necessarily…

Durable-Goods Orders as an Economic Indicator

Watching economic indicators can be an advantageous approach to identifying opportunities to introduce tactical tilts to a portfolio as market conditions change. The volume of durable-goods orders, an important…

Where to Hold Emergency Savings and Other Short-Term Cash

Holding excessive amounts of cash is an expensive position to take, thanks to the concept of opportunity cost. From a probabilistic standpoint, for the privilege of holding excess cash an investor is paying the difference between the interest rate on cash and the expected return from other investment…

Considerations for Investing in Your Employer

Individuals often have the option to invest in their employer via stock equity through an Employee Stock Purchase Program (ESPP), employee stock options plan, or restricted stock units, which can serve to effectively align incentives to create long-term value and provide employees the opportunity to meaningfully participate in such value creation. These plans often…

The Outlook for Oil Demand Growth

Even with the growth of the “sustainable energy” industry, due in large part to technological advances and government subsidy policies, worldwide oil demand has continued to grow as fossil fuels have provided the energy that individuals, families, and businesses need in growing economies. That growth may…

Diversification vs. Concentration for an Investment Portfolio

A number of investors make an attempt to outsmart and outperform the market by building an under-diversified portfolio concentrated on a few selected stocks that they believe are “better” investments than the broader market. It’s important to understand the fundamental principle in…

Quantifying Environmental, Social, and Governance Risks

Investors have recently shown increasing interest in offerings that focus on environmental, social, and governance (ESG) sustainability. As this WSJ article notes, “in the first half of 2020, net flows into sustainable funds totaled $20.9 billion in the U.S., compared with $21.4 billion for 2019 as a whole.” An apples-to-apples comparison, however…

A Weak Dollar and Stock Investing

The U.S. dollar has recently been weakening considerably relative to other currencies, driven at least in part by exceptionally low interest rates that reduce the appeal of holding the dollar. While the impact of a cheaper currency is complex and not entirely predictable, it does bring…

The Fed is Focusing on a Strong Labor Market

The Federal Reserve operates with a dual mandate to support employment levels and to keep inflation under control. These objectives can be in tension with each other, since fundamental economic theory proposes that one is often achieved at the expense of…

Money Market Funds Amid Ultra-Low Interest Rates

Institutions and individual investors often employ money-market funds as a way to invest assets for a very short period of time when they would like to achieve a nominal return that’s above zero while theoretically shielding their money from short-term volatility. While this is typically not an…