When an industry experiences a sea change driven by shifting consumer trends and technological advancement, investors may find both new opportunities and new risks to cash flow. The auto industry is experiencing just such a disruption, as electric vehicle technology, rideshare trends, upstart competitors, a global pandemic, and…

Discounting Future Cash Flows in an Economic Recovery

At any given point in time, the value of the stock market reflects all future cash flows, discounted to the present at the appropriate cost of capital. This is important to understand because equities do not and should not necessarily correspond to current economic conditions. In the context of a recession, understanding the probabilistic recovery outlook can…

The Impact of Economic Conditions on Renewable Energy

Companies face a constant challenge to maintain relevance and financial viability as economic conditions, customer preferences, and government policies change. Adept investors identify and overweight companies that successfully assess and adjust to these changes. The energy sector is currently dealing with the challenge of lower consumer demand and the resulting lower prices; as this article notes, “the coronavirus pandemic has…

Gold as a Safe Haven

The spot price of gold attained an all-time high on Monday, July 27, drawing the attention of investors worldwide. The precious metal is often employed as a hedge against inflation and market uncertainty, based on the theory that gold should retain its value when equity and bond prices fall, or when currency is devalued and nominal prices rise. It’s worth noting that gold does not…

Perspective in Earnings Season

With earnings season upon us, quarterly company reports can provide information that assists investors in analyzing trends and identifying beneficial investment opportunities. Revenue and profit margin data help to paint a picture of how current economic conditions and consumer behavior are impacting company operations. Cash flow statements and balance sheets enable an assessment of…

Relative Asset Class Valuations and Tactical Allocation

When asset classes like stocks, bonds, and real estate deliver markedly different returns over a given period of time, it may be beneficial for investors to tactically rotate from a relatively more expensive asset class to a relatively less expensive one. The broad higher price movement of equities since…

Saving and Investing for College

Several different tax-advantaged options are available to support the endeavor to save and invest for higher education expenses. Parents can employ these when planning for their children’s college costs, and individuals may take advantage of these options to fund their graduate-level…

Extended Tax Deadline Opportunities

Tomorrow, July 15, is the extended deadline for 2019 tax returns. Of equal significance, until tomorrow individuals have the ability to move assets to tax-sheltered accounts. The extension for filing tax returns also applies to the deadlines for contributing to Individual Retirement Accounts (IRAs) and…

Technological Advances in Battery Design

The energy sector has recently trended toward the use of batteries for energy storage to increase the efficiency of energy grids, particularly for load-leveling renewable energy production and usage. According to…

Increased Dividend Payments in a Recession

Even in the midst of macroeconomic distress, some companies manage to dependably produce a sufficient level of positive cash flow to increase the dividends that they pay out to investors. As the below article from Kiplinger mentions, “…if dividend…

Business Development Companies

An interesting segment of financial markets comprises business development companies (BDCs), which tend to invest in the debt of small and mid-size businesses. BDCs are often attractive to income-seeking investors because they are incentivized by tax law to distribute at least…

Portfolio Strategy When The Future Is Uncertain

When constructing a portfolio and selecting investment positions, individuals can make the tempting mistake of trying to predict what the future holds. This approach is flawed because predicting an occurrence fails to account for the probabilistic nature of the world in which we live. Political elections, pandemic abatement, weather patterns, and consumer…

The Benefits and Drawbacks of a Roth IRA Conversion

A Roth IRA conversion option offers investors the opportunity to potentially benefit from re-designating the status of a retirement account from pre-tax to post-tax. Since investors are required to pay income taxes on the amount converted from a Traditional IRA to a Roth IRA, lower equity prices can…

Fed Policy and Bank Stress Tests

The Federal Reserve influences several factors that may impact investors in a critical sector of the economy: large financial institutions. Many investors count on large banks for dividend income and stable, diversified growth in an environment defined by technological disruption and general uncertainty. Within the context of recent macroeconomic developments, the Fed will…

Tax Strategy Planning

Federal and state taxes account for a large portion of cash outflow for most investors, so it can be beneficial to create and implement a deliberate tax strategy to incorporate the most up-do-date tax regulations that apply to each respective investor. Considerations include tax bracket ranges, whether a Roth or…

How to Manage Emergency Cash

Emergency cash savings are an essential portfolio allocation for most individual investors.

The challenge is to hold an amount of cash that’s sufficient to meet potential emergency financial needs, while minimizing the amount of assets that are held…

Ultra-Low Interest Rates for the Foreseeable Future

Interest rate levels impact appropriate investment allocation considerations in a multitude of ways, including the relative advantages of investing in capital markets versus paying down debt like mortgages and students loans, pros and cons of allocating to bonds based on their respective durations, the cost of capital for…

Stimulus Efforts from the European Central Bank

As investors look to allocate their global, geographically-diversified portfolios, it is important to understand the role that national and local governments may play in economic dynamics. Even in countries with capital markets that are largely based on the principles of free market capitalism, governmental entities often

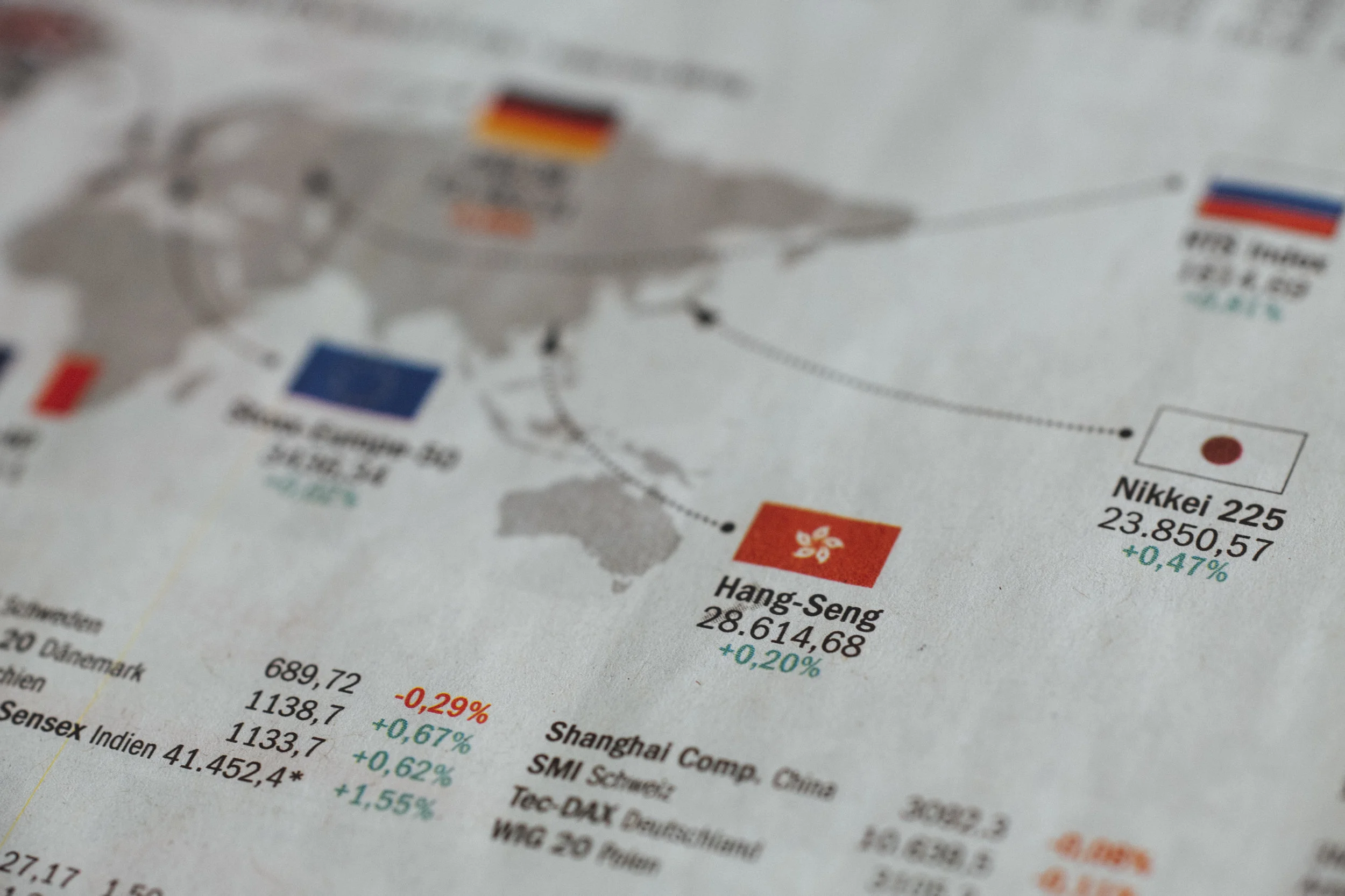

Economic Cycles and International Stocks

Equities in different countries often deliver varying rates of return as economic factors and relative valuations differ across geographic regions. Investors should be aware of this and allocate their investment portfolios accordingly while considering risk tolerance and expected return.

Following recent market movements, as the below article notes, “foreign stocks trade at…

Private Equity Investing in Times of High Uncertainty

Investors often find that temporary recessions provide an opportunity to invest at lower relative prices and therefore achieve outsize returns on long-term investment positions. Many private equity firms are seeking to do exactly that in the current environment on behalf of their investors, but they’re faced with…