Economic Cycles and International Stocks

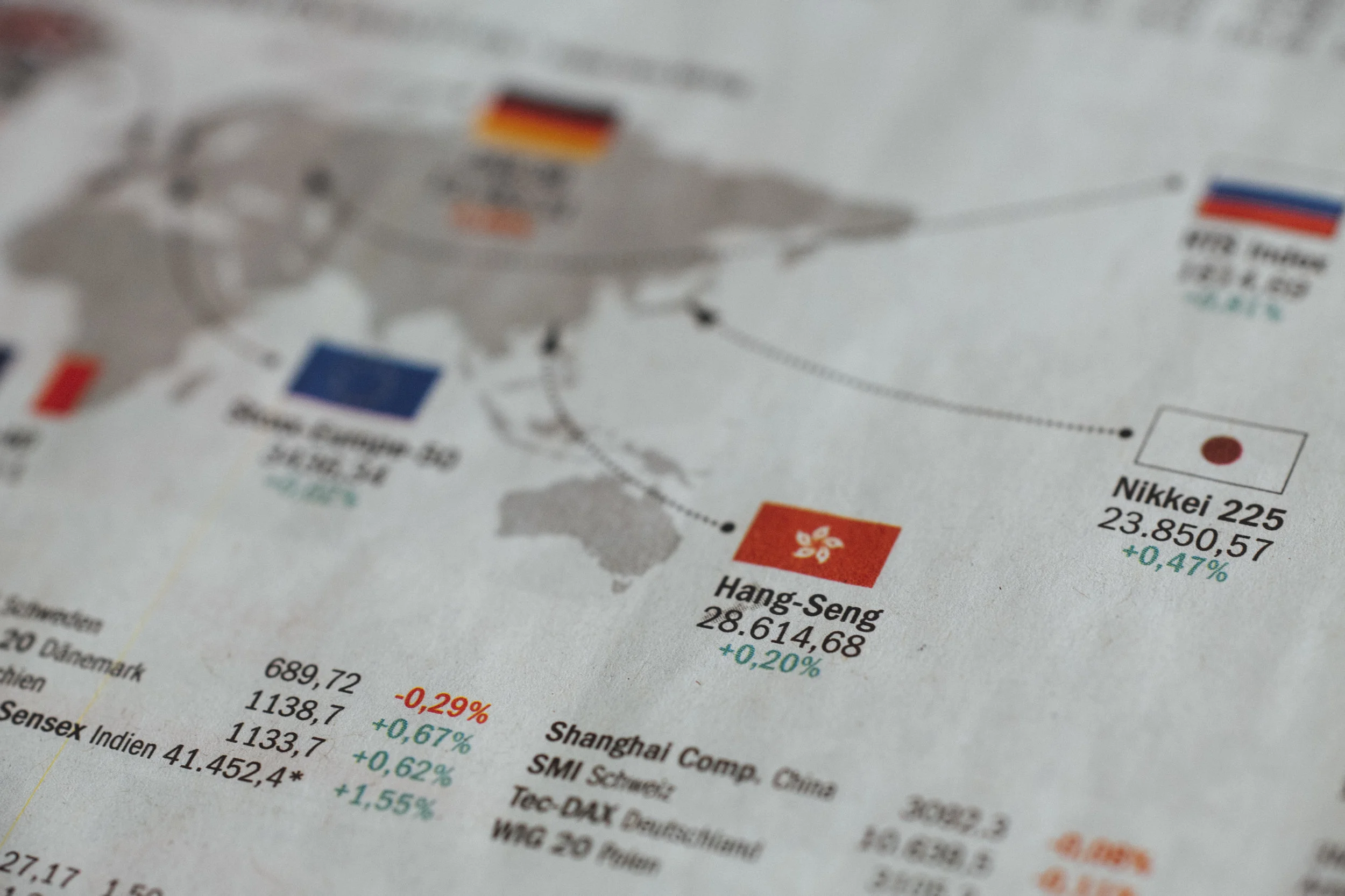

Equities in different countries often deliver varying rates of return as economic factors and relative valuations differ across geographic regions. Investors should be aware of this and allocate their investment portfolios accordingly while considering risk tolerance and expected return.

Following recent market movements, as the below article notes, “foreign stocks trade at roughly 14 times expected earnings for the year ahead, a 20% discount to their long-term average multiple,” while “U.S. shares, by contrast, trade at a 20% premium to their historical average.”

While this relative valuation metric is not a sufficient stand-alone reason to overweight a portfolio in international stocks, it’s worth noting in the context of a holistic portfolio allocation strategy.

Read more on this subject here: https://www.kiplinger.com/article/investing/T024-C000-S002-keep-a-delicate-balance-with-foreign-stocks.html

— Anthony Winkels is Managing Partner and Wealth Advisor at Fortis Wealth Management