Tariff Considerations in an Administration Change

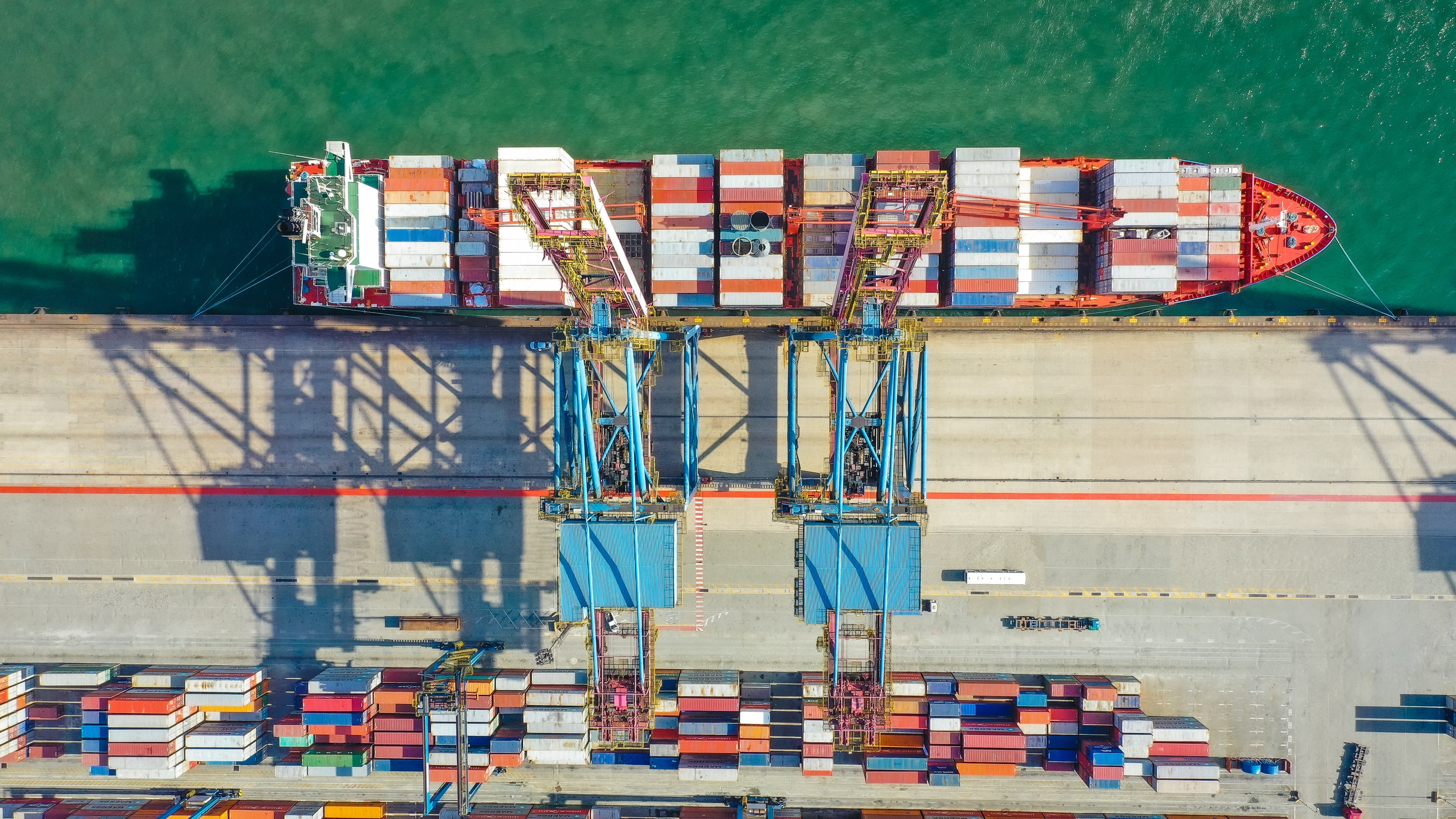

International stocks comprise a meaningful portion of most appropriately allocated diversified investment portfolios, which serves to mitigate idiosyncratic geographic risk. For countries that engage in extensive trade with the United States, such as China, tariff policies can have an outsize impact on the cash flows and valuations of companies that are domiciled in those countries.

In the case of international trade relations, the U.S. president has a significant impact on policy since Congressional approval often isn’t required in order to implement major changes. As this article notes, “the president has broad authority to conduct negotiations and peel off or apply new tariffs as he sees fit. It’s really going to be one of the few policy areas where [Mr.] Biden can show results and do so unilaterally.”

That being the case, it will be beneficial for investors with international equity exposure, particularly in China, to assess the president-elect’s policy positions and potential actions as they relate to trade.

Read more on this subject here

- Anthony Winkels is Managing Partner and Wealth Advisor at Fortis Wealth Management