Even in the midst of macroeconomic distress, some companies manage to dependably produce a sufficient level of positive cash flow to increase the dividends that they pay out to investors. As the below article from Kiplinger mentions, “…if dividend…

Business Development Companies

An interesting segment of financial markets comprises business development companies (BDCs), which tend to invest in the debt of small and mid-size businesses. BDCs are often attractive to income-seeking investors because they are incentivized by tax law to distribute at least…

Portfolio Strategy When The Future Is Uncertain

When constructing a portfolio and selecting investment positions, individuals can make the tempting mistake of trying to predict what the future holds. This approach is flawed because predicting an occurrence fails to account for the probabilistic nature of the world in which we live. Political elections, pandemic abatement, weather patterns, and consumer…

The Benefits and Drawbacks of a Roth IRA Conversion

A Roth IRA conversion option offers investors the opportunity to potentially benefit from re-designating the status of a retirement account from pre-tax to post-tax. Since investors are required to pay income taxes on the amount converted from a Traditional IRA to a Roth IRA, lower equity prices can…

Fed Policy and Bank Stress Tests

The Federal Reserve influences several factors that may impact investors in a critical sector of the economy: large financial institutions. Many investors count on large banks for dividend income and stable, diversified growth in an environment defined by technological disruption and general uncertainty. Within the context of recent macroeconomic developments, the Fed will…

Tax Strategy Planning

Federal and state taxes account for a large portion of cash outflow for most investors, so it can be beneficial to create and implement a deliberate tax strategy to incorporate the most up-do-date tax regulations that apply to each respective investor. Considerations include tax bracket ranges, whether a Roth or…

How to Manage Emergency Cash

Emergency cash savings are an essential portfolio allocation for most individual investors.

The challenge is to hold an amount of cash that’s sufficient to meet potential emergency financial needs, while minimizing the amount of assets that are held…

Ultra-Low Interest Rates for the Foreseeable Future

Interest rate levels impact appropriate investment allocation considerations in a multitude of ways, including the relative advantages of investing in capital markets versus paying down debt like mortgages and students loans, pros and cons of allocating to bonds based on their respective durations, the cost of capital for…

Stimulus Efforts from the European Central Bank

As investors look to allocate their global, geographically-diversified portfolios, it is important to understand the role that national and local governments may play in economic dynamics. Even in countries with capital markets that are largely based on the principles of free market capitalism, governmental entities often

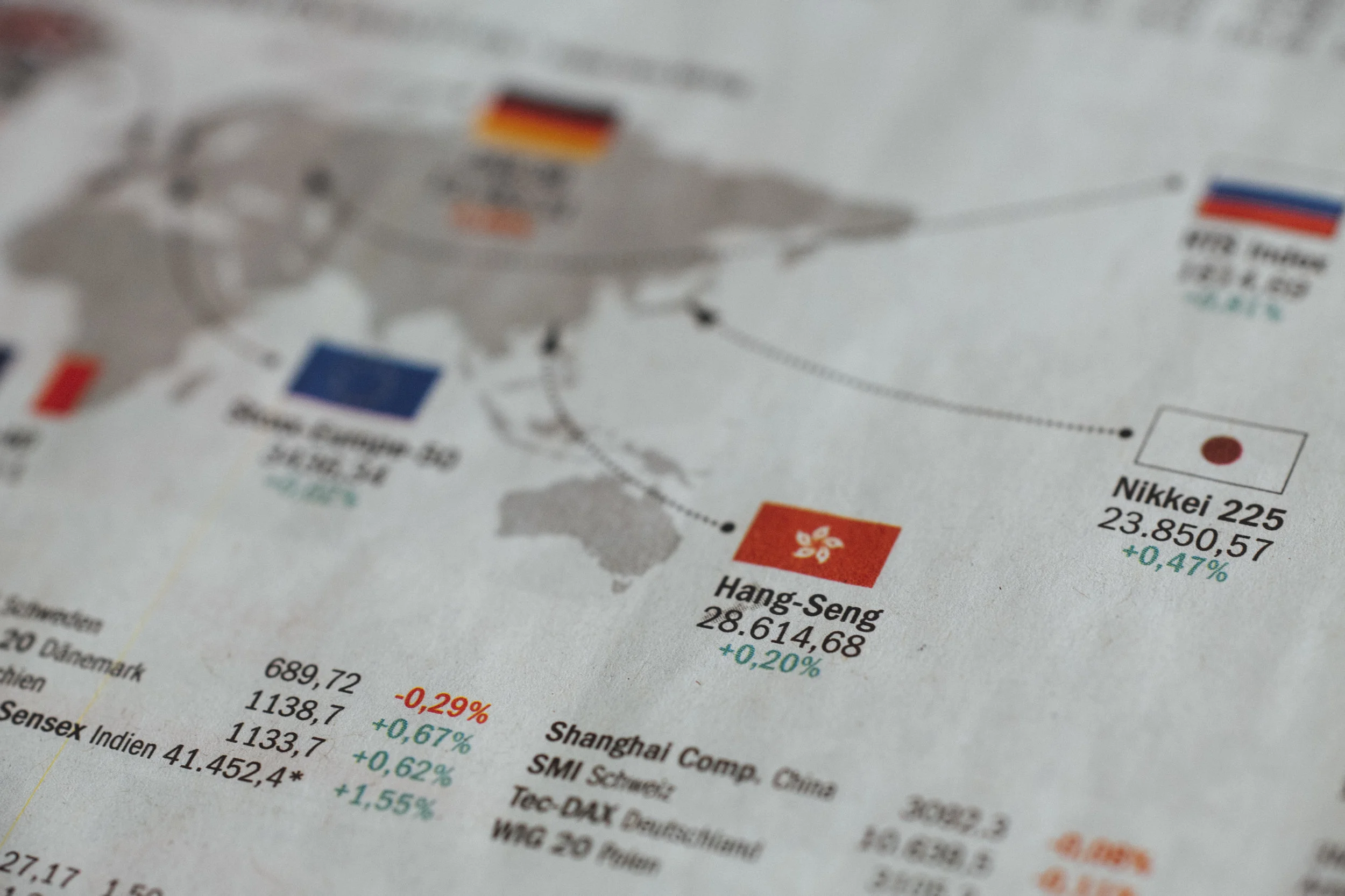

Economic Cycles and International Stocks

Equities in different countries often deliver varying rates of return as economic factors and relative valuations differ across geographic regions. Investors should be aware of this and allocate their investment portfolios accordingly while considering risk tolerance and expected return.

Following recent market movements, as the below article notes, “foreign stocks trade at…

Private Equity Investing in Times of High Uncertainty

Investors often find that temporary recessions provide an opportunity to invest at lower relative prices and therefore achieve outsize returns on long-term investment positions. Many private equity firms are seeking to do exactly that in the current environment on behalf of their investors, but they’re faced with…

Managing Liquidity in a Challenging Economic Environment

In a recessionary environment, many companies are faced with the challenge of adhering to their debt covenants, paying interest on their bonds and bank debt, and ensuring liquidity for ongoing operations. This is important to stock investors because equity shareholders in a company hold claim only to…

Gauging the Economy in Earnings Season

Over the past week, we've had the chance to assess the impact of recent economic tumult on business operations, revenue, and profit margins as companies reported earnings for the first quarter of 2020. Earnings reports and…

Timeless Investing Principles

Tumultuous capital markets serve as an important reminder to incorporate basic, timeless investing principles when constructing, building, and maintaining a portfolio. Investors are reminded that: bonds are not without…

Gaining Historical Insight from Past Recessions

Looking at today’s stock, bond, real estate, and commodity markets in the context of history can be a useful exercise. A balanced view of history can provide valuable perspective that mitigates myopic fear and prevents investors from making knee-jerk…

The Basics of Stock Investing

The ability to invest in stocks may well be one of the most beneficial opportunities that exists for individuals in an economy that incorporates characteristics of capitalism. Investing in stocks, or equity, gives individual investors ownership of a piece…

Deliberate Portfolio Rebalancing

An investment portfolio should be allocated to provide the risk/return profile that meets the investor’s needs in support of his or her financial goals, risk tolerance, and investment time horizon. This allocation strategy can be developed with an understanding of the probabilistic expected…

Incorporating Emerging Market Bonds in a Portfolio

Bonds issued by sovereign governments typically offer investors cash flow in the form of coupon payments and principal repayments that are backed by the ability of the government to…

A Dividend Income Strategy Must Account for Potential Yield Reduction

Equity dividend yields are an essential element in the portfolios of many investors. Dividends enable investors to directly receive free cash flows that exceed a company’s…

Investing in Individual Companies: Earnings Reports

Earnings reports from the first quarter will provide investors a glimpse into how companies are dealing with the recessionary pressures of early 2020. While we should…