Supply Chain and Investing

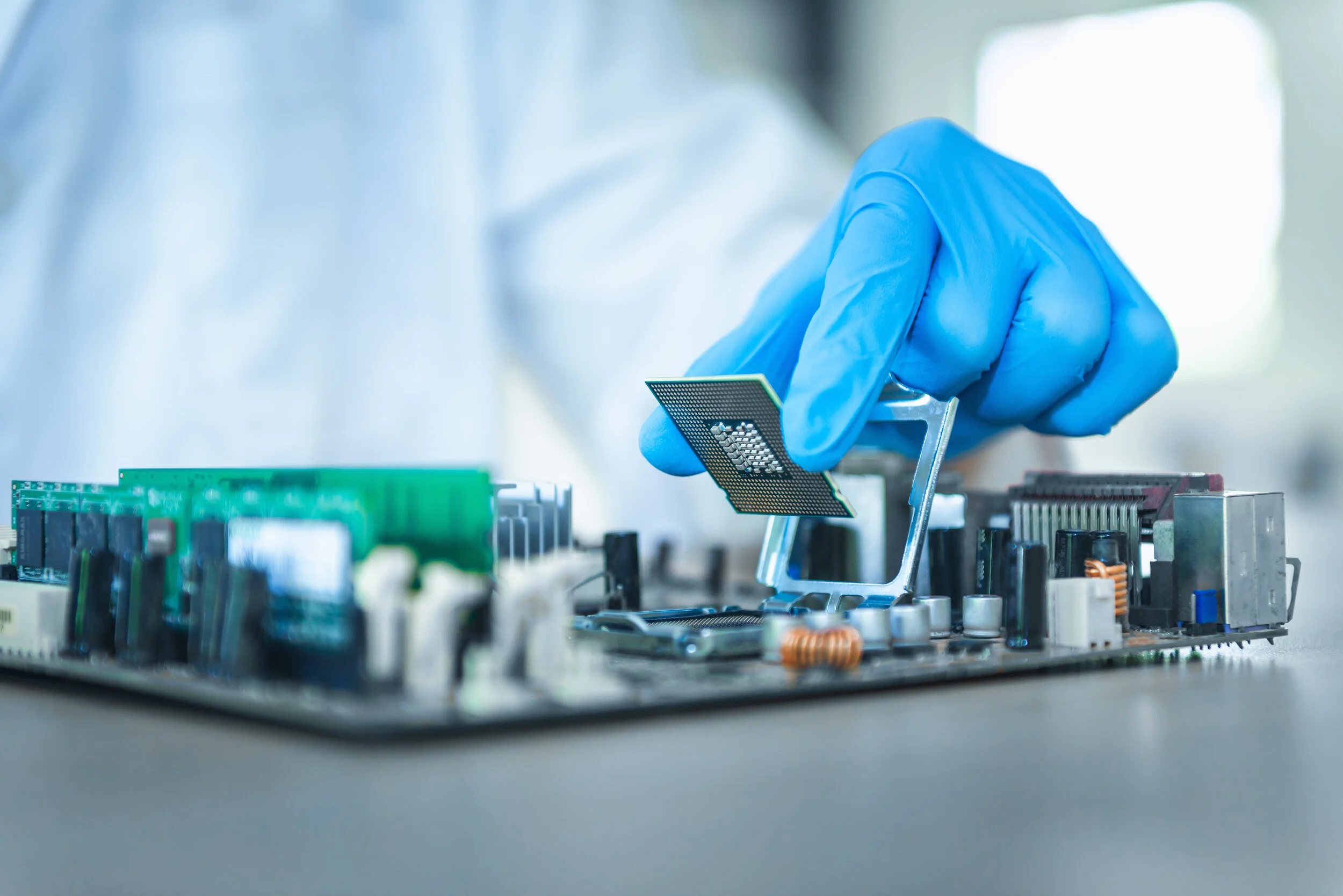

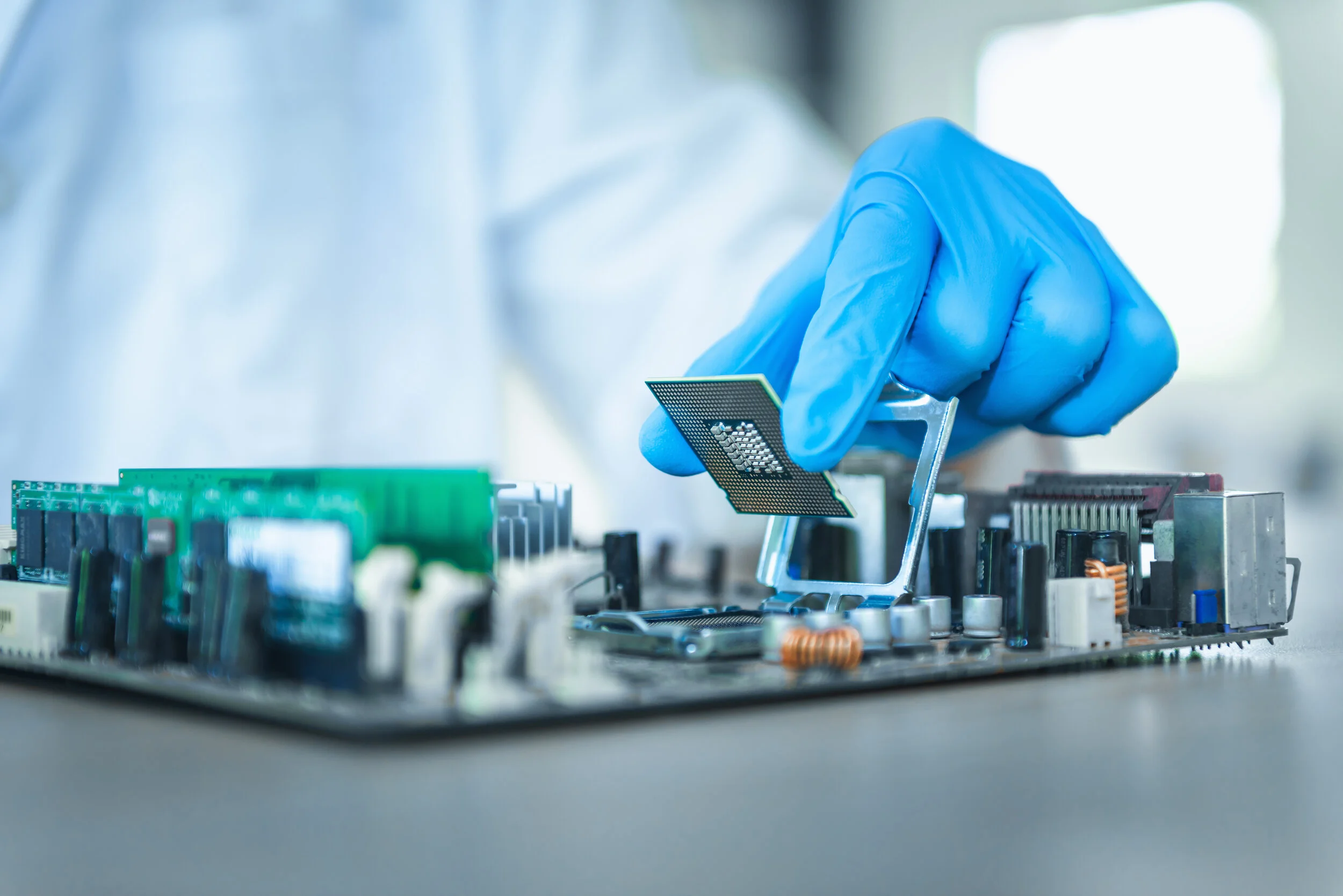

A product is only as good as its inputs, and when it comes to investing in cutting-edge technology, the availability and affordability of product inputs can make the difference between an exceptional return on investment and a bankrupt company. One such example is the case of the semiconductors required for new auto and truck models, as described in this article.

In an environment with pent-up consumer demand and abundant funding available in the form of stimulus checks and ultra-low interest rates, potential car buyers are eager to purchase, but auto manufacturers are hamstrung by a global shortage of the necessary semiconductors. Investors can search for both risks and opportunities in supply-chain disruptions like this. Understanding the interconnectivity of products and inputs is a crucial element in supply-chain investing.

Read more on this subject here

- Anthony Winkels is Managing Partner and Wealth Advisor at Fortis Wealth Management